Section 179 Deduction Suv 2025. Gvwr, >50% business use) work vehicles (dump trucks, tractors). Section 179 deduction is a tax provision designed for small businesses, allowing them to deduct the full purchase price of qualifying assets in the year they are placed in service.

It begins to be phased out if 2025 qualified asset additions. Section 179 deduction for suv for business.

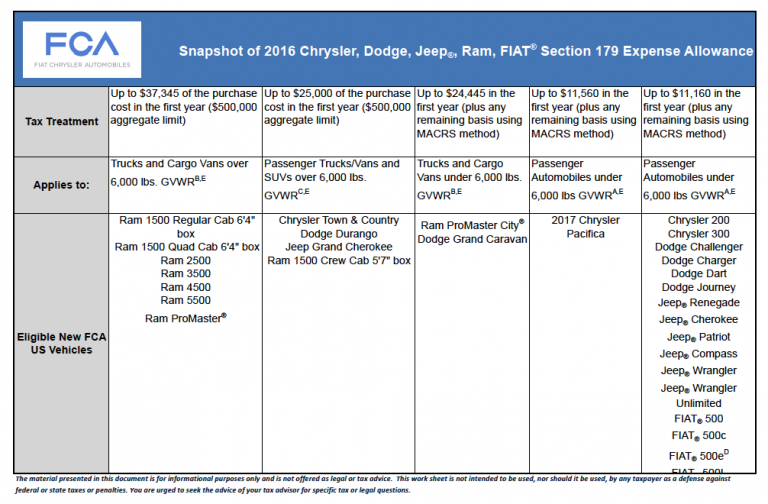

Section 179 tax deduction applies to passenger vehicles, heavy suvs, trucks, and vans are used predominantly (over 50%).

Section 179 Vehicles List 2025 Lynde Ronnica, 179 deduction for tax years beginning in 2025 is $1.22 million. Link to irs publication here.

Section 179 Tax Deduction, 101 rows what vehicles qualify for the section 179 deduction in 2025? For vehicles under 6,000 pounds in the tax year 2025, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of.

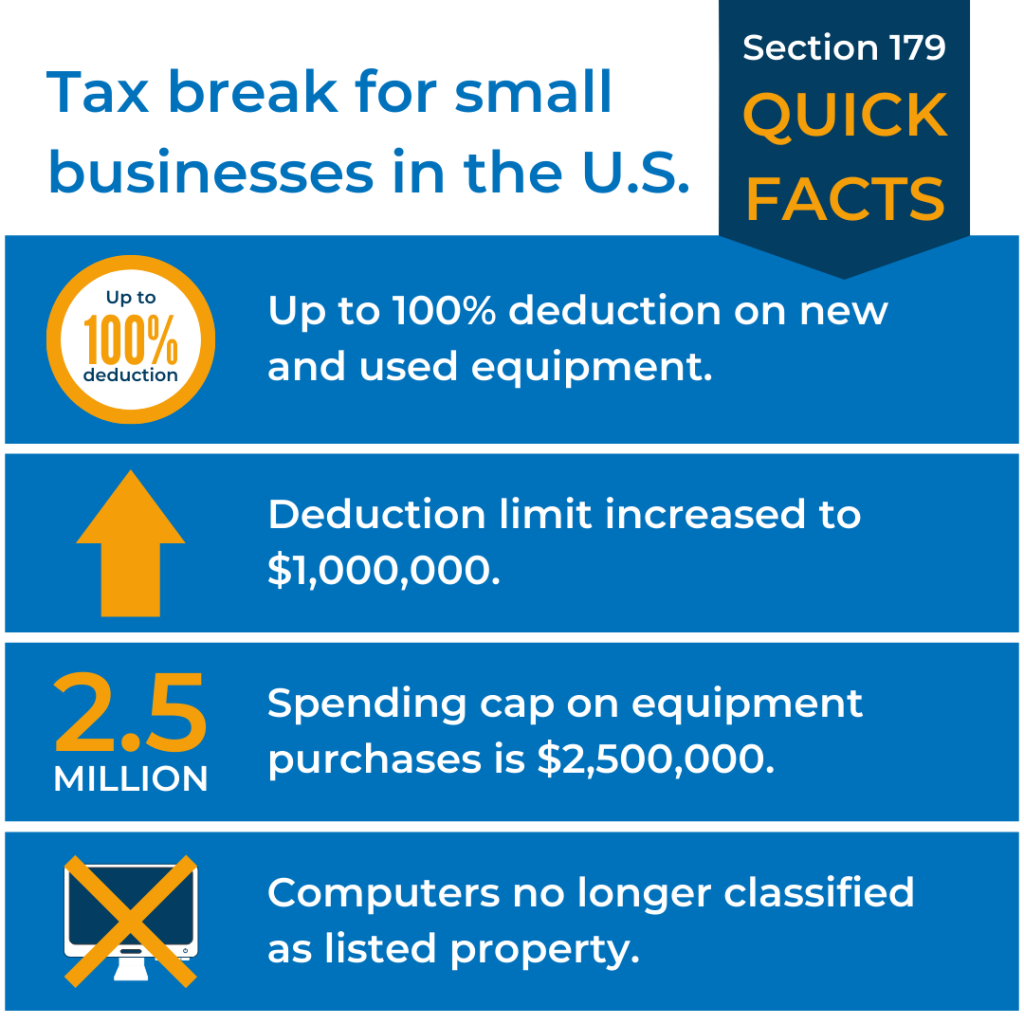

Section 179 Tax Deductions Infographic GreenStar Solutions, Section 179 tax deduction applies to passenger vehicles, heavy suvs, trucks, and vans are used predominantly (over 50%). The 2025 section 179 deduction is $1,220,000, which is $60k higher than it was in 2025.

Irs Section 179 Deduction Vehicle List 2025 Amii Lynsey, Essential considerations for business vehicle tax deductions under section 179. Updated on january 19, 2025.

2022Section179deductionexample QTE Manufacturing Solutions, For tax years beginning in 2025, the maximum section 179 expense deduction is $1,160,000. Updated on january 19, 2025.

Section 179 Tax Deduction Pittsville Ford Pittsville, MD, For 2025, businesses can take advantage of 80% bonus depreciation. 101 rows what vehicles qualify for the section 179 deduction in 2025?

Forklift Section 179 Deductions, Section 179 deduction for suv for business. This is the largest deduction the irs has ever offered small businesses.

The Ultimate Fleet Tax Guide Section 179 GPS Trackit, “with a view to redressing the grievances faced by such deductors/collectors, the board, in partial modification and in. Outlining the types of property that qualify for the deduction;

2025 Sec 179 Electric Vehicles Chart Crista Kaycee, 179 deduction for tax years beginning in 2025 is $1.22 million. Essential considerations for business vehicle tax deductions under section 179.

Section 179 Tax Deductions Infographic GreenStar Solutions, Irs section 179 covers business deductions for. Your section 179 deduction is generally the cost of the qualifying property.